There are teams of accountants and enrolled agents (EAs) available to help you navigate your way through any business-related concerns. One stellar feature that Bookkeeper.com offers is free financial advice and software training with all of its service plans. Bookkeeper360 offers both accrual and cash-based accounting while Bookkeeper.com only offers cash-based accounting. In today’s fast-paced world, financial management is essential for businesses of all sizes. Accounting services serve as the backbone of any successful business, providing clarity, compliance, and …

General Ledger and Chart Accounts

With Bookkeeper.com, you can choose from two pricing plans, based on the number of transactions you make per month. Bookkeeper360 is a cloud-based accounting service provider that offers financial reporting assistance to small and medium businesses. When a user creates an account in the system, he is provided with a personal manager. Business owners can combine Bookkeeper360 with their existing accounting platform to ensure the most efficient financial management. Bookkeeper360 offers the ability to create your own custom plan, and as such, the features you select depend on your company’s specific needs and business strategy.

QuickBooks Live

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services. We require our bookkeepers and CPAs to take continuing education courses and maintain active software certifications. Our team-based approach ensures that you get the knowledge and expertise you need on your accounting team.

InvoiceBerry Review: Features, Pricing, & Alternatives

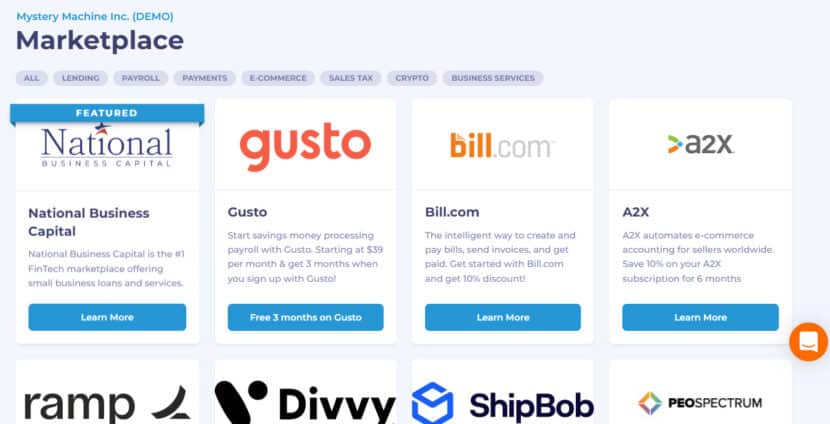

Bookkeeper360 also integrates with other payroll providers like Gusto and ADP. If you decide to get this service, it should take less than two weeks to set up. As an entrepreneur myself, I am dedicated to researching the software and services that will streamline accounting processes, ultimately saving time and money.

- This allows business owners and their accountants to stay up-to-date on their finances and make informed decisions on the go.

- Some companies on our list specialize in startups, with strategic cash-burn analysis, Series A-C funding guidance, and tax strategies to boot.

- Despite these significant benefits of Bookkeeper360, there are also downsides to this online bookkeeping service worth considering.

- If you want a more detailed view of business performance, you can switch to the Metrics view to year-over-year data for revenue and common size amounts for gross profit, net income, and payroll.

- While you can hire an accountant or buy any accounting software, they might not fulfill your needs.

You can integrate Xero and seamlessly link your chart account and general ledger to simplify the processes. So, in this Bookkeeper360 review, we will share our experience and honest opinion. We’ll explore the unique features, use cases, benefits and find how pocket-friendly its plans are. While you can hire an accountant or buy any accounting software, they might not fulfill your needs. Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service. The cash runway, also called cash burn rate, shows the estimated number of months until cash runs out.

Like Bookkeeper360, Bookeeper.com is a U.S.-based online bookkeeping service provider that works with small businesses. With the Weekly plan, you’ll receive a dedicated accountant who will perform your bookkeeping on a weekly basis. This plan will also include cash bookkeeper360 review and accrual basis accounting and reporting, as well as invoice and expense management, technology consulting, monthly financial reviews and weekly catchup calls. Bookkeeper360 can work with a variety of payroll solutions, including top providers like Gusto and ADP.

If the hours you spend working with your accounting software could be better spent elsewhere and you’re already using the software as efficiently as possible, it might be time to hire an online bookkeeping service. Ultimately, it can benefit your business by freeing up your time and ensuring your books are up to date. This puts your business in a solid position come tax time and helps you keep a finger on the pulse of its financial state.

Ultimately, this feature is crucial to your business bookkeeping processes because it helps lower errors and boost customer satisfaction and cash flow. The accountants will match records with transactions, pinpoint any missed entries and rectify errors. You also get the chance to review and approve the reconciliation reports online.

The columns represent the volume of cash inflows and outflows while the line shows your net cash position. By using this chart, you can assess monthly cash needs based on expected cash inflows and outflows. It shows that revenue sometimes increases, decreases, peaks, or plummets. This revenue source is not present in all months while merchandise licensing is consistent in almost all months. As a business owner, you can use this chart to analyze revenue not just as a whole but in different components.

Bookkeeper360 has several different services and solutions for business owners, and the total cost will vary depending on the services selected. Depending on the needs of your business, you can choose from the pricing plans that are offered for Bookkeeper360’s individual services, or you can work directly with its team to customize a service plan. While one of the priciest bookkeeping services on our list, Bookkeeper360 should not disappoint. In fact, its premium price is what’s kept it from the top spot on our list. We offer scalable solutions for one time projects or on an ongoing basis. Some of the ways we help our clients is with cash flow optimization, key performance indicators (KPIs), growth strategy consulting, profitability analysis, and pricing & cost analysis.